ESTATE PLANNING

Estate Planning is the process of creating a plan to control what happens to your minor children, your property, and your health care upon your mental incapacity or death. If no planning is conducted, the decisions of what happens to your children or property is left to the probate court, with no input from you. Courts are unpredictable and expensive, so the goal of estate planning is to either avoid the probate courts altogether through PROBATE AVOIDANCE planning techniques, or to provide you with some control through the probate courts with PROBATE PROTECTION planning techniques.

The primary job of the probate court is to supervise the legal process by which all debts, taxes and other financial affairs of people who die in that county are lawfully resolved, and to ensure that the money and other property left, after debts are paid, are distributed to the persons legally entitled to receive them. If advance planning does not occur, a person’s final wishes are left to the statute of descent and distribution, also known as the intestacy statute. This is the law that defines how the probate assets in an intestate estate will be distributed to the decedent’s heirs after all claims, expenses and taxes have been paid. Generally, the statute favors those heirs most closely related to the decedent.. Probate courts handle estate administration and guardianships, while juvenile courts deal with minor child custody. If advance planning occurs, matters will either avoid the courts completely, or at a minimum, the wishes and directives of the person that dies or becomes incompetent are considered by the courts. Watch the video to hear a simplified explanation of probate law.

It is never too early to consider probate options because the unexpected can happen at any time. The truth is, if you have people or property that you want to protect, you should engage in some type or probate planning. It is always best to leave as little up to the probate court as possible. As such, at our firm we recommend at least some probate planning. A description and summary of each is listed below.

“End of life decisions should not be made at the end of life.”

— Author Unknown

ADVANCE PLANNING

Advanced Planning is the best way to control outcomes for probate legal matters. While it is often best to avoid probate entirely (Probate Avoidance), creating an advance plan to control the probate court process (Probate Protection) often makes sense for most people’s situation. Continue reading for a commonsense explanation on why and how to plan for the unthinkable.

PROBATE AVOIDANCE

PROBATE PROTECTION

Probate Avoidance consists of the methods designed to ensure that the probate court is avoided altogether. There are multiple methods that will accomplish this goal. Common methods are TOD’s and beneficiaries. Transfer on death designations, known as TOD’s, title assets like automobiles and real estate, so that they will transfer to a named party upon death of the owner and avoid the probate process. Named beneficiaries on financial accounts like retirements and life insurance, allow property to be transferred to a named person upon the death of the account owner, also by avoiding probate. A more complicated, but expensive method to avoid probate is to establish a trust. Trusts are beneficial for high asset individuals and typically require a lifelong commitment to maintenance.

LEARN MORE…

A trust exists when one person (often called the grantor or settlor) gives property to another person (called the trustee) to hold and manage for one or more other persons (called the beneficiaries). Under the Ohio Trust Code, a revocable trust (sometimes also known as a “living trust”) is a trust that the grantor can amend (change) or revoke (cancel) during his or her lifetime. Through the terms of the revocable trust, the grantor keeps all the benefits of any property placed into it for the rest of his or her life. The grantor also can be the trustee. The grantor’s spouse or a trust company also often serves as trustee. A revocable trust can be funded with any property such as checking accounts, savings accounts, brokerage accounts, stocks and bonds, a home and other real estate. Some revocable trusts may not be funded initially, but rather at a later time or at the grantor’s death. An attorney can help advise when a trust should be funded and with what property. The terms of a trust are described in writing in a document often called the declaration of trust or trust agreement. You may wish to create a revocable trust to accomplish one or more purposes. First, you may wish to fund a revocable trust in order to avoid probate. If you, acting as a grantor, re-title your property in the name of the trustee of a revocable trust, that property generally is not subject to the jurisdiction of the probate court after you die. Second, a trust can provide estate management for your family after your death. Finally, you may wish to create a trust to reduce or defer estate taxes.

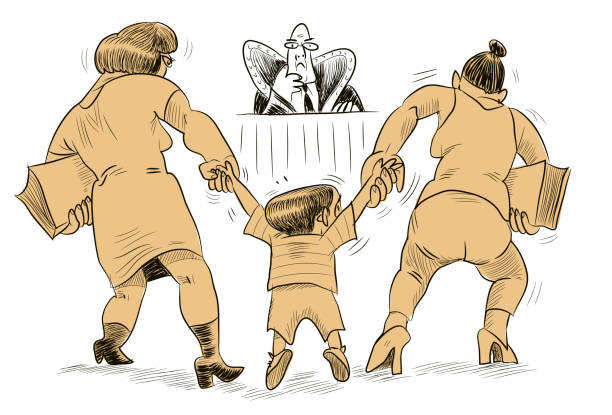

Probate Protection consists of the methods designed to control court’s decisions or allow the court to consider your wishes when making decisions. The most common methods include financial powers of attorney, health care powers of attorneys, living wills, and simple wills. In some cases, more complex methods are utilized, like complex wills when there are multiple people being left assets, or declaratory trusts when, providing for the care of minor children upon death of a parent. A will is a document that sets forth how a person would like to have his or her probate property distributed upon death. It can also make a declaration on how to care for minor children upon death, so that the courts can factor it into the court’s decision.

LEARN MORE…

To be valid, a will must meet certain formal legal requirements. Everyone who owns any real or personal property should have a will, regardless of the properties’ value, because the purpose of the will is to ensure that the property is distributed the way you want it to be distributed, regardless of its value. Keep in mind, your estate may grow in value almost unnoticed through, for example, the repayment of mortgages, appreciation of stocks and other investments, or inheritances from relatives.

FAILURE TO PLAN

Failure to Plan is the worst of all options. If the unthinkable occurs and you have not planned in any way, you are at the mercy of the State of Ohio.

Your Estate is determined by the Probate Courts. If you die without a will, or intestate, as the law calls it, your probate property will be distributed to your nearest family members according to a formula fixed by law. In other words, if you do not make a will, you cannot control who will receive your probate property. You also cannot choose who the court will appoint to administer your estate.

Custody of your minor children and the indirect control of the property you leave them is determined by the Juvenile Courts … – The parents of a minor child are the child’s joint natural guardians and thus are equally responsible for the care, nurture, welfare, education, and estate of the child. However, if something happens to the minor’s parents, the probate court must act in the best interests of the minor or incompetent, has broad discretion in appointing guardians, and will be reversed only when this discretion is abused. Without preplanning, any property left to the minor child, will be under the control of the person that secures custody, which means they will have control and decision making on how the money left to your children is utilized

FREE CONSULTATION

If you would like to learn more about how estate planning can help you, please feel free to signup, for a free, no hassle, 15-minute session with our estate planning attorney, Mitch Stowers. He can answer your questions and provide you with options, as well as pricing for a plan designed to protect the things you love should the unthinkable occur. Select an open time slot below, provide the necessary information, and Attorney Stowers will call you by telephone to further discuss.

FEE SCHEDULES

The goal of our firm is to be as honest and transparent as possible for individuals engaging in advance planning. In furtherance of this goal, we post our fee schedule, and turnaround times, so it is clear and obvious what options will cost and how long it will take to complete the services.

| Product | Description | Price | Prep Time |

| ESTATE PLANNING | |||

| Complete Probate Packet | Will, healthcare directives, & financial POA | $500 | 2 Weeks |

| Will Only | Final will and testament | $350 | 1 Week |

| Health Care Only | Healthcare POA, Living Will, & Organ Donor Dec. | $250 | 1 Week |

| Financial Only | Complete financial power of attorney | $200 | 1 Week |

| Revocable Living Trust | Living trust and all accompanying documents | $1,700 | 3 Weeks |

| Testamentary Trust | Will with trust created through the will | $1,000 | 3 Weeks |

| TOD Designation | Transfer on death designation in title document | $300 | 1 Week |

| Deed | Real estate transfer deed preparation | $100 | 1 Week |

| ESTATE ADMINISTRATION | |||

| Full Administration | Complete probate of an estate through probate | TBD | TBD |

| Summary Release | Summary release from probate | $1,000 | TBD |

| Relief From Admin. | Relieve from administration in probate | $1,500 | TBD |