Income Limits

Bankruptcy Law

Income Requirements To Qualify For Bankruptcy

MANY FACTORS ARE EXAMINED to determine if a person should/could file for bankruptcy and which chapter of bankruptcy is the best choice. One of the most important factors is your household income level. To file for chapter 7 bankruptcy a person’s household income level must be below the allowable adjusted median income for that household size. If you income is below the allowable level you may be able to file for either a chapter 7 bankruptcy or a chapter 13 bankruptcy. However, if your income level is above the allowable level, you cannot file for chapter 7 bankruptcy protection, leaving you with chapter 13 as your only possible bankruptcy option.

How Household Size Is Determined

HOW IS HOUSEHOLD SIZE DETERMINED for bankruptcy qualification purposes? Oddly enough, the term is not defined by the bankruptcy laws. It was left up to the bankruptcy courts to define the term. As you can imagine, the term household size has been defined in many ways by the numerous bankruptcy courts throughout the country. The “Heads On Beds” definition literally looks at the number of people that reside in the home. The “Income Tax” definition looks at the number of people listed on the income tax of the person filing for bankruptcy. The “Economic Unit” definition looks at the number of people that act as one economic unit whereby factors like financial support, dependents or whose finances are closely commingled.

Adjusted Median Income

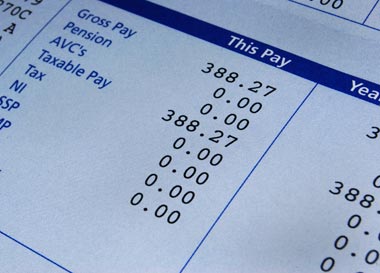

ADJUSTED MEDIAN INCOME is obtained by taking your average gross income over the last 6 months for every person deemed part of the household. The gross income is all regular income sources except for Social Security income.

Income from employment, self-employment, child support, and many other government benefits is included. Allowable deductions are then taken from this gross total to figure out the adjusted median income.

THESE ALLOWABLE DEDUCTIONS are not the same deductions utilized in IRS income tax filings determinations. It is a complex calculation, but some of the allowable deductions subtracted from the gross income include tax deductions from pay, mandatory retirement deductions, health insurance premiums, life insurance, child support withholding orders, and established totals numbers for food, shelter, transportation, and clothing as established by the bankruptcy court based on your household size.

A good rule of thumb is that if your gross income (no deductions) is below the adjusted median income level for a household of your size, you will have chapter 7 bankruptcy and chapter 13 bankruptcy available to you as options to explore.

If your gross income is above the adjusted median income for a household of your size, it is advisable to utilize the services of an experienced attorney/lawyer to make these calculations and determine if you have both bankruptcy chapter available as options.

- Bankruptcy overview

- Chapter 7

- Chapter 13

- Income

- Non-Dischargable

- Student Loan

- Wait to File

- Debts

- Credit Repair

- Home Ownership

- Lawsuit Protection

- Wage Garnishment

- Tax Relief

- Vehicles

- Bankruptcy and Payday Loans in Ohio

- Bankruptcy Discharge Reinstatement Fees

- Bankruptcy Trustee

- Best Bankruptcy Attorney

- Why Use Bankruptcy Lawyer

- Avoiding Mortgages and Judicial Liens Through Bankruptcy in Ohio